IRS Announces Change in Form 990-N Submission Website

Effective February 29, 2016

The Internal Revenue Service (IRS) recently announced that it is changing the website it uses to collect information from IRS Form 990-N filers. The Form 990-N is a very brief annual filing that smaller tax-exempt organizations are able to utilize in place of submitting the lengthier Form 990-EZ or Form 990. Many state, regional, and local affiliates and chapters of national nonprofit organizations qualify to submit the 990-N.

The Form 990-N submission website will change as of February 29, 2016. All nonprofit organizations submitting Form 990-N should consider filing by February 28, 2016 in order to use the old submission website. Starting February 29, 2016, in order to file the Form 990-N, all nonprofits will be required to complete a one-time registration and file Form 990-N submissions through the IRS’s website: www.irs.gov/Charities-&-Non-Profits/Annual-Electronic-Filing-Requirement-for-Small-Exempt-Organizations-Form-990-N-e-Postcard

Who Must File the Form 990-N

The Form 990-N is a short, 8-question filing that must be filed by organizations whose annual gross receipts are normally $50,000 or less. An organization meets this criterion if it:

- Has been in existence for 1 year or less and received, or donors have pledged to give, $75,000 or less during its first taxable year;

- Has been in existence between 1 and 3 years and averaged $60,000 or less in gross receipts during each of its first two tax years; and

- Is at least 3 years old and averaged $50,000 or less in gross receipts for the immediately preceding 3 tax years (including the year for which calculations are being made).

Alternatively, organizations meeting the above criteria may choose to file a complete Form 990 or Form 990-EZ. However, organizations rarely choose to do this, because these forms are much lengthier, comprehensive, and more time-intensive than the Form 990-N.

Some organizations are not required to make any type of Form 990 annual filing with the IRS, such as churches and organizations included in a group Form 990 return (note that simply being part of a group tax exemption does not relieve a member of the group of the annual IRS filing requirement). Organization managers who are uncertain as to what filing obligation—if any—they have should consult with legal counsel.

When the Form 990-N Must Be Filed

The Form 990-N (as well as the Form 990 and the Form 990-EZ) must be submitted to the IRS by the 15th day of the 5th month after the close of an organization’s tax year. This means that for an organization whose tax year ended on December 31, 2015, the Form 990-N must be filed by May 15, 2016.

How to File the Form 990-N

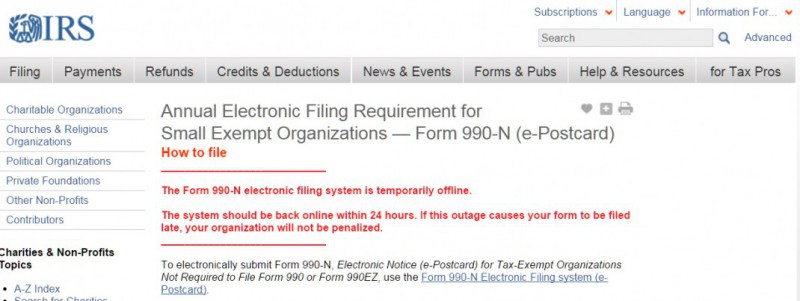

The Form 990-N must be submitted electronically. The Urban Institute will continue to host the Form 990-N website through February 28, 2016. Starting February 29, 2016, the IRS will host the Form 990-N submission website. This website is not currently active, but is expected to be up and running on February 29, 2016.

The IRS has acknowledged, however, that it is possible for technical issues to delay the implementation of the new Form 990-N submission process. Should this occur, the IRS states that it has put in place systems “to prevent organizations from being penalized if their filing due dates occur before the system is in place.” Given the possibility for glitches that may delay the IRS roll out of the new system, if an organization is able to do so, it should consider submitting its Form 990-N on or before February 28, 2016.